An idiot discusses call options I

DISCLAIMER: As #COM superstars @Josh_Young_1, @WhiteTundraSG and others note, there is great risk in call options. Best approach them assuming you will lose 100% of your investment. Full disclosure: Call options represent less than 1.5% of my portfolio.

I heartily recommend following jleqc’s advice and checking out Shubham’s video (linked above).

With that out of the way, my rationale for investing in call options is because I believe that the demand for oil is going to remain high, and is a tailwind for energy stocks. Because of this, the odds of being successful with call options are way, way better than buying Lotto tickets, with payouts that range from 10+% in a month or two to 1,000+% if you buy long-dated calls (I like ones that are 1+ year out).

So what’s a call option?

Per Investopedia: “Call options are financial contracts that give the buyer the right but not the obligation to buy a stock … at a specified price (the strike price) within a specific time period. A call buyer can profit when the (stock) increases in price.”

So you pay for the right to buy shares at the strike price before some specific time in the future. If the stock share price rises above the premium you paid plus your strike price, then you profit.

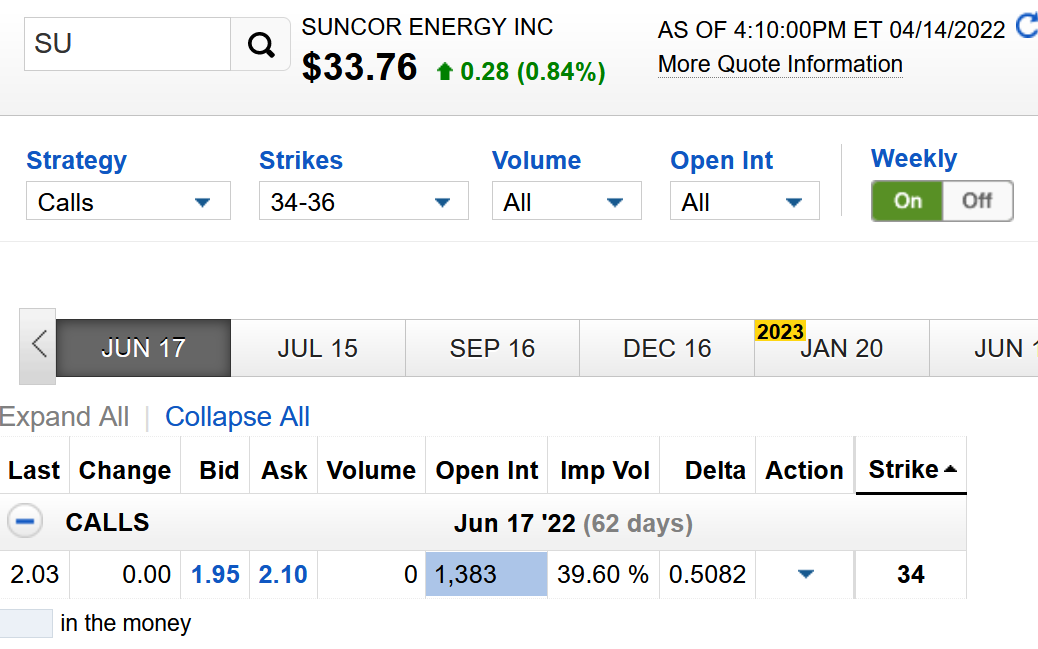

Let’s take a look at an example that was available to U.S. investors

this past Maundy Thursday (Note: all screens from U.S. Fidelity site)

Here’s Suncor for 17-JUN-2022

“Last” indicates the last price paid for the option in question; “Bid” is the price prospective buyers have stated they will pay; “Ask” is the price sellers are willing to accept; the “Bid-Ask Spread” (“spread” for short) is the range between the two. “Open Int” is the number of call options held — indicating where the action is. The right-most column is the “Strike price.”

As you can see below, For Jun 17: At the $34 strike price, the Bid-Ask spread is $0.15 (from $1.95-$2.10); the last trade settled at $2.03, and 1,383 active calls have been bought and sold.

One call option gives you the right to buy 100 shares, so in order to buy one “$2.03” call, the buyer must pay $203.00 plus a brokerage commision (for Fidelity, it’s $0.65 to open one call and another $0.65 to close one call) — a total of $204.30 for the right to buy 100 shares of SU at $34.00/share.

Since those 100 shares would cost the call buyer $3,400 + $204.30 or $3,604.30 ($36.043/share), the buyer breaks even if SU shares increase to $36.05. Every penny SU goes above $36.05 is potential profit to the call buyer.

Suncor is expected to report earnings on 09-MAY.

Let’s say SU has solid earnings and rises to $37.09 on 03-JUN. How much was your return?:

Share price: $37.09

Strike price: $34.00

Premium: $2.03

Commissions to open/close call: $1.30

Your profit would be calculated thusly:

($37.09 * 100) - ($34.00 * 100) - ($2.043 * 100) =

$3,709 - $3,400 - $204.30 = $104.70

Your return would be your profit divided by the cost of your call option.

$104.70 / $204.30 = 51.25%

** WHAT IF: Supposing SU blows out earnings on 09-MAY and surges to $42.38?

Your profit:

($42.38 * 100) - ($34.00 * 100) - ($2.043 * 100) =

$4,238 - $3,400 - $204.30 = $633.70

Your return:

$633.70 / $204.3 = 310.2%

** Of course, the danger is Suncor does Suncor things, and the stock drops.

At any price below $36.05, your call options will be worth zero. This is why you should assume that any call options you buy are like Lotto tickets.