Prayers up for @GoForGrubes2

00:06:00 Why are the investors in our energy/commodities trade so balkanized? Selling NG names. Is this a return to buy high, sell low? @DennisMolson joins.

00:13:00 @HectOracle this is the perfect time to buy NG stocks such as $PNE and $TOU. Why $EC vs. $PNE? Liquidity, an NYSE listing, and trading one company that was smashed ... for another. Hector asks about $EC, and a simple thesis is laid out for Ecopetrol and PBR.A.

00:20:00 @jim_duffus is production going up? Are the $CNQs and $TOUs using this to drop prices and do M&A? @realpeterlinder joins. He talks TOU, PNE and NG prices. Higher oil prices will lift the gassy names. Peter recently moved into $NVA.

00:28:00

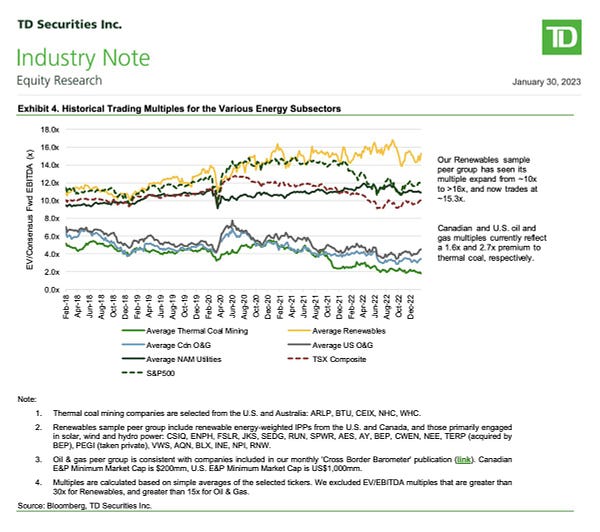

Gugo's tweet spurs @jleqc to discuss coal and minerals. Will coal rerate? Will it just be a bond? A bond with a 60% dividend? Battery minerals? Governments will support them. Oil and NG?

00:35:00 Speaking of bonds, the 100% FCF bond, Yancoal, is brought up. Are the good times done? Juxtaposing $CNQ vs. $WHC. "You have to ignore the $3B in cash sitting in the bank of the $10B company." ... What happens when oil hits $110?

00:41:00 @RazorOil notes oil-sands production is at record highs. Athabasca is getting ready to return 75%. ... Is the era of the Eric Nuttall bump over? Some names mentioned on Friday's Market Call didn't move. Malaise?

Dennis, Peter and J discuss fund managers who hold large chunks of companies. Good and bad are discussed. One thing can't be forgotten, however, without Eric, many of us wouldn't be in the trade.

00:53:00 @RazorOil: Blame the game, not the player. Low NG costs is a boon for the oil sands. Razor discusses NG production in the U.S. and Canada, and how the increased production is leading to the current pricing. "Energy cannot be created or destroyed. It is transferred."

1:07:00 Welcoming @KVickers to the stage. Kevin asks about the U.S. and Chinese Strategic Petroleum Reserves. Duff and Razor thank Kevin for his service to Canada.

1:13:00 @DSteinmoeller asks about $IPCO and Black Rod. Razor does a deeper dive on oil-sands producers.

1:22:00 @Albertagarbage discusses the FCF decision to finance Black Rod. Will investors punish $IPCO? The Lundins are empire builders with a long-term view.

1:39:00 @TwinTurboCe1ica talks Aussie coal and a major victory he just experienced on a junior silver miner. Twin talks the ASX and some of his moves.

1:59:00 @mfwarder joins after crossing the Alps on four flat tires. Channeling Willie, Matt is hitting the road again ASAP.

2:08:00 Matt is triggered by the mention of Corsa Coal. Matt discusses the name -- partially owned by THE LUNDINS! What about the Russians?

2:21:00 COM's ambassador to Defenestra V (Soviet-era surplus Death Star) @ReserveList joins to discuss urea and ask about potash and coal.

2:25:00 @YellowLabLife talks about Teck front-running its earnings. ... The conversation switches to Ivanhoe.

2:33:00 Matt talks about "Cobalt Red" author Siddharth Kara's appeance on Joe Rogan. The Koala pivots to proposing Western companies continue to work in EM mines to improve the lives of indigenous workers while minimizing harm to the environment.

2:50:00 Koala talks about China's belt-and-road program. China's deals aren't good for the countries in question, and now there is more of a call for Western support instead of Chinese. Bruski asks about a Global Atomic project in Niger.

3:00:00 @Vmaxpax discusses EU demand for oil products, the Russia embargo and China becoming Europe's gas station. V also discusses the shadow tanker fleet. V touches on many things, including a safety risk with older vessels being insured by the Russian Central Bank.

3:11:00 "Have we reached materials market maturity?" (say that three times fast). "You do not want to understand the dark worlds of mining ... the forbidden fruit ... bad bad things happen."

3:17:00 Bruce asks about $SGML (Sigma Lithium). Koala expounds. ... Matt: "It's going to be a pretty interesting decade." Koala closes by noting a universal truth: Those of us in the trade "want to find the folks we trust." …

... "What is the FCF yield of XOM or CNQ? When we talk about a single asset, a small cap or a niche-ier, less-diversified company, what is the FCF of that? Am I getting compensated enough? Am I getting paid to make this more complicated."

High-Energy Tuesday