00:01:30 @philoinvestor and @WhiteTundraSG join. Shubham thinks that the markets are more interesting now than from 2014-2021. We touch a bit on Antero Resources/$AR.

00:05:30 Shubham discusses OPEC and its actions in relation to the Biden Administration.

OPEC wants stability. The U.S. must be careful.

00:09:30 Shubham gives a quick solution to fix U.S. gas prices. Would the administration implement this plan?

00:10:30 @jleqc we're in a perfect bearish storm. Weekend was a cloud of bullish stories, but so far a red week.

Apathy is a problem. No good news for oil bulls is priced in. All bearish news is. James shares charts from Q4 / U.S. election season that show the S&P 500 surging.

00:19:30 James laughs at coal ripping since 2020.

Everyone in the energy trade is betting that humans remain stupid until we sufficiently profit. Can Greta evolve? James says don't bet against the educational power of the internet.

00:25:30 @rockcreekfreak touches on I3 Energy/$ITE/$ITEEF failure in the North Sea. But fear not, I3 investors: Rock discusses the company's drilling successes in Canada and notes the company has a good valuation.

00:34:00 Will I3 drill again in the North Sea?

Shubham gives his thoughts on the UK. Rock talks about I3's untapped Canadian lands. A third of the company is available for sale -- is it a takeover target?

00:39:00 @RazorOil talks about yesterday's pain, and the relationship between Canadian products and U.S. refineries.

Razor talks Iraqi production.

Philo touches on his piece on German/Euro energy politics.

00:45:30 Philo gives a general outline of Antero Resources/$AR. The biggest story is half the company's NG production is poorly hedged -- the company is very profitable, has debt in control, but had ~$500M in Q2 hedging losses.

The hedges fall off at 2022YE, and 75% of production can be piped to LNG terminals on the East Coast and the Gulf Coast. Additionally, the company produces a large amount of NGLs.

Shubham gives his thoughts on the UK. Rock talks about I3's untapped Canadian lands. A third of the company is available for sale -- is it a takeover target? 00:39:00 @RazorOil talks about yesterday's pain, and the relationship between Canadian products and U.S. refineries.

·

Razor talks Iraqi production.

Philo touches on his piece on German/Euro energy politics.

A short note on Germany's energy politics, its historical context and the Euro.

·

00:45:30 Philo gives a general outline of Antero Resources/$AR. The biggest story is half the company's NG production is poorly hedged -- the company is very profitable, has debt in control, but had ~$500M in Q2 hedging losses.

The hedges fall off at 2022YE, and 75% of production can be piped to LNG terminals on the East Coast and the Gulf Coast. Additionally, the company produces a large amount of NGLs.

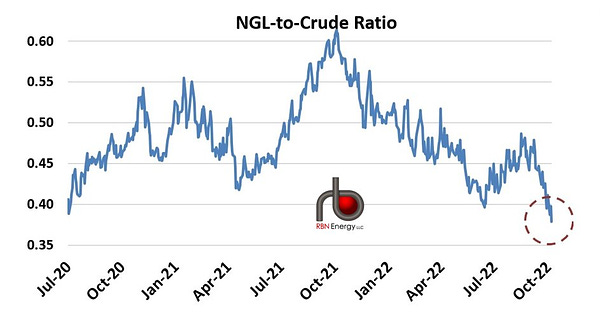

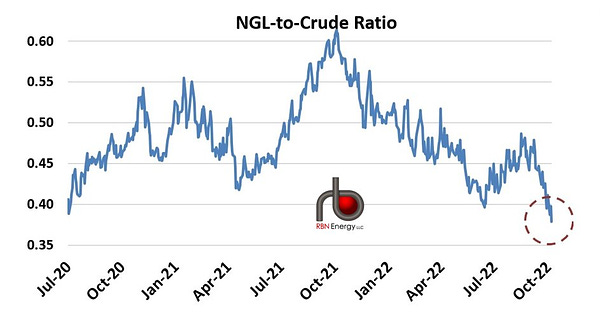

00:54:00 Do plummeting NGL prices put AR's profits at risk? Rock Creek discusses ethane prices dropping being a potential factor. What differentiates Antero? It's a high FCF company (comparable to Crew Energy/$CR/$CWEGF), but a liquid listing for U.S. investors.

1:02:00 @InvestInOnG discusses Antero's strengths: Being a wet gas producer and the hedges dropping off. @timber001 touches on 75% of AR production having egress to LNG facilities, allowing AR to earn a premium to Henry Hub.

You can compare $AR and how it did in Q2 to a number of #COM companies here.

https://docs.google.com/spreadsheets/d/1KqXzZ1I_ln39TYttCeYvrkuzcHNe4sojDrKZ931SZb4/edit?usp=sharing

1:16:00 @RazorOil on the supply picture. Razor looks at several countries, their production, and production trends. "It's a legit energy security conversation." Shubham says UAE has spare capacity, but won't increase production. Shale has masked so much.

1:23:00 @rakoraja pivots back to Antero. He notes that the company updates its realized NGL pricing on a weekly basis -- domestic and international. The price/BOE was ~$52 in Q3. Shout-out to @BubleQe and strong corporate communication: "Tell me, show me, pay me!"

1:29:00 @jleqc there are no data points on the other (bearish) side of this trade. "The trend whose premise is false." James harks back to the earlier discussion on time of year, and explains why the odds appear good that this will be a profitable Q4.

1:36:00 @HectOracle joins and notes how people will take profits as companies approach 52W highs. Fundamentals don't matter in these situations -- investors/funds are locking in profits. $TVE is a perfect example, Hector says.

If/when we get a second bite of the 52W apple, how do we play it? @jleqc's experiences help buttress Hector's point.

1:45:30 @coenjarts expands on the narrative discussion. He sees a scenario where super majors come to Canada and start gobbling.

Could a Shell or a Conoco gobble Tourmaline? Tourmaline?! Jody says names are valued at record lows, and Mike Rose has made and sold companies before. Jody discusses how he will trade during the next 6-12 months. "Automatic switches are the thing to do" based on valuations.

1:52:30 "Somebody is going to start buying somebody. ... Buy quality." There will be a desire for institutional money to deploy itself into the #COM Space. Jody sees value-based individual stock investing will return to the detriment of index-based investing.

2:00:30 @HalfbeardCanada discusses his philosophy for getting into and out of names. Protect your nest egg and "buy yourself a sweater." @MasBest2point0 wants to have cash to trade around.

2:08:30 @WhiteTundraSG -- on risks of selling early.

had coffee with @AjaypaulC, stirs the divvy vs. buyback pot, and notes Rio Tinto's windfall courtesy of Canadian taxpayers. @jleqc tries to apologize but @InvestInOnG says, "Better angels, my ass."

2:16:00 @Nandospage did OPEC really cut?

Nando asks about ROK Resources/$ROK/$PTRDF. Shubham discusses Saudi possibly dropping production lower than announced, and talks his thesis on small caps such as ROK.

2:26:00 @jleqc talks oil-field services, and his indecision regarding Trican.

Options vs. juniors selling at ridiculous valuations. Buy the tiny guys and wait? @Jleqc says options haven't been as kind as getting in early on shares of undervalued firms. 2:33:00 A few months ago, $WHC/$WHITF WAS trading at over 100% FCF/EV. Good values are still there.

But look for companies that are actually producing, and possibly have optionality, not companies that AREN'T producing.

2:42:00 Deep deepened his I3 position during the morning's dip. @timber001 bought into $PIPE. Car shopping on the agenda -- not Shelby GT shopping.

Take advantage of FOREX and buy a car in Canadian pesos?

2:50:00 Duff bought a chunk of $IPCO. Deep likes their WCS-diff hedging. IPCO's FCF going to fund its Blackrod oil sands? Onion Lake, Garlic Breath and the county inspection site at Blueball.

@InvestInOnG's geography leads to a conversation about how screwed the U.S. Northeast is because it refuses to build energy infrastructure. "They want to go back to the dark ages." 3:05:00 It's much better for the environment to build a pipeline.

We discuss Enbridge Line 5, Michigan politics, and Midwestern energy insecurity. The gasoline shortages in France leading to rioting. Duff says Bill Bonner has predicted what's happening in France could spread to the U.S.

3:15:00 @Nandospage saves us from a dire political discussion by asking about fertilizer names. Deep has $NTR calls. I have some $UAN.

Deep recommends having some cash handy for dips. How much? When to deploy?

3:26:30 @WhiteTundraSG closes out on a high note, discussing the $FANG acquisition (spoiler alert: Shubham is not a fan). Shubham also previews his upcoming banger session reviewing all #COM stocks he covers (2-3 minutes per name). More info here:

https://www.whitetundra.ca/events

High Energy Tuesday