Intro technical difficulties, @jleqc discusses the @garquake method of sharing knowledge and thoughts, but not being addicted to the trade.

00:04:00 Evaluating Whitehaven Coal ($WHC/$WHITF)

00:09:00 @JamesHMackay joins and discusses his desire to get access to thermal seaborne coal via $WHC. He also talks met coal to thermal switching with met being priced so low vs. thermal.

00:14:30 Is the Fed going to destroy everything? ... While USD is crushing AUD, CAD, EUR, the Mexican Peso is doing just fine. Half of Canada moved to Mexico? No, just half of unvaxxed Canada.

00:24:30 @WTIBull makes a cameo from Bulgaria. It's a small sliver of anecdotal evidence, but he saw potential signs of demand destruction in Albania.

00:26:30 @thebiglong9 joins and discusses coal before the conversation switches to British politics of the moment.

00:35:00 Big discusses his capital return preferences: Buybacks vs. dividends.

Big discusses the example of Dillard's Department Stores (DDS) that soared from ~$25 to $400 after the Dillard family started aggressively buying back shares.

00:42:30 @energyburrito finishes supper and joins. ... The danger of keeping buybacks in place after a stock has rerated. ... Warren Buffett is a buyback fan.

@IlliniProgrammr discusses why he's pro dividend.

@InvestInOnG and @pijoe1212 keep having technical difficulties ("It's rubbish!"). @jamesyachyshen joins. @energyburrito and @IlliniProgrammr discuss demand destruction.

1:03:00 @AhmedBa44329064 joins and discusses some unique hedging by $VET.

01:21:30 @MichaelKantro joins to discuss the oil market in 2007-08.

Michael discusses how the dollar was sinking at that time, and Emerging Markets were booming.

1:34:30 @pijoe1212 discusses the lack of CAPEX and contrasts Serica Energy (currently the subject of a takeover bid) vs. a UK company that is paying out large dividends.

2:00:00 @HalfbeardCanada Labor is a major issue in the oil industry.

2:07:00 Pete says that the drumbeat of "climate change" has scared young people away from working in energy.

2:12:30 We didn't need tinfoil, but @InvestInOnG joins, and I reach for the Reynolds Wrap. Deep has moved into a cash-ier position.

Pete discusses finding FCF gems, buying them, and "sitting on your hands."

2:25:00 @Michael71718318 joins and discusses risks to Cheniere LNG.

@jleqc: Is it different this time? @Michael71718318 thinks it's more of the same. Michael talks about catching falling knives and Pete says to focus on what we investors have, not on what we don't have. The summer is the primary reason things are down.

Michael builds detailed financial models of the companies he owns. He sees Suncor as quite undervalued. Michael's substack post on $SU:

02:51:30 @mfwarder joins and discusses thermal coal. Matt says there is no replacement for Russian coal, so thermal coal prices will remain elevated. Coal power plants in PA, NJ, WV, VA have critically low stockpiles.

A railroad strike could could create havoc in the Midwest.

There are no tons of thermal available. Met has been weak because of China, but U.S. met coal should be trading at a premium and isn't.

03:00:30 CEIX has a new longwall coming on line. Is it at risk?

Matt says the future is bright for @WHC, $NHC and $CEIX because of thermal coal.

Matt says $CEIX is better positioned than most to resolve logistical issues.

Matt thinks the 100% FCF Whitehaven thesis is in the realm of possibility and refers us to the Tweetings of @YellowLabLife.

03:06:30 Can Australian thermal help Europe this winter? Matt discusses what South Africa, the U.S., Latin America and Australia could do (TL/DR: Not enough).

@MiserMcMiserson asks if petroleum coke can be substituted for coal. Miser says petcoke from Athabasca could theoretically help Europe.

@JamesHMackay asks about met coal/thermal switching. Matt treats us to a deep dive into the subject.

The peak is here for met coal (Q2). How quickly will companies return value to shareholders. Matt sees a $185-$190 floor for met pricing, which would be fine for U.S. producers. Thermal is just getting started.

Matt riffs on whether the U.S. will increase coal use; whether utilities will start extending the life of coal plants; and potential hedging.

03:45:30 Matt discusses $BTU. ("These guys are going to make money hand over fist").

Peabody's capital return program might be delayed until 2024, but that means the company will pay down debt, and the rest will sit on the balance sheet. Could this be another Serica situation? Not likely.

@rockcreekfreak takes the stage to talk coal(!). Who are you, and what have you done with the real Freak?!

03:55:00 @MQTrading asks about $AMR and $ARCH. What could ARCH's special dividend look like in Q2? Matt thinks $10-$15, which would be a 28%-42% annualized divvy. He's thinking about $65 in 2023 (46%). "It's a lot. They're going to do OK, but take it with a grain of salt."

$CEIX? Matt sees them as a 2023 story, with adjusted EBITDA/share of $67. Thanks, Matt!

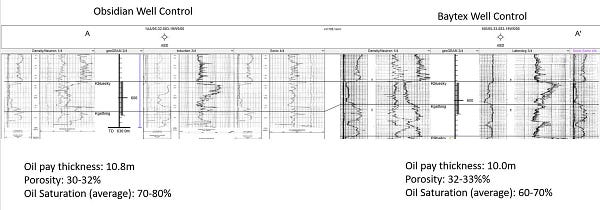

04:02:00 @rockcreekfreak returns in cheeseburger-ly form and discusses Obsidian's new Blue Sky wells. ... Rock thinks the company takes some bold chances.

“The porosity of rock? He explains it to me like a Golden Retriever."

04:27:30 @WhiteTundraSG joins us to discuss rental-car strategies; Orange County (CA) real estate; and a number of other subjects. Shubham is renting exotic cars for a song. He wonders why @elonmusk doesn't buy the Canadian energy patch and rule the world.

Shubham will be hosting a seminar on Saturday on Whitecap, Crescent Point and Hemisphere.

Share this post