00:4:30 Discussing buybacks of 43 #COM companies. IMO is one of the good companies. SDE, ITE, LOU, ATH, OBE are on the other side of the coin. Dilution is a reason @jim_duffus prefers dividends.

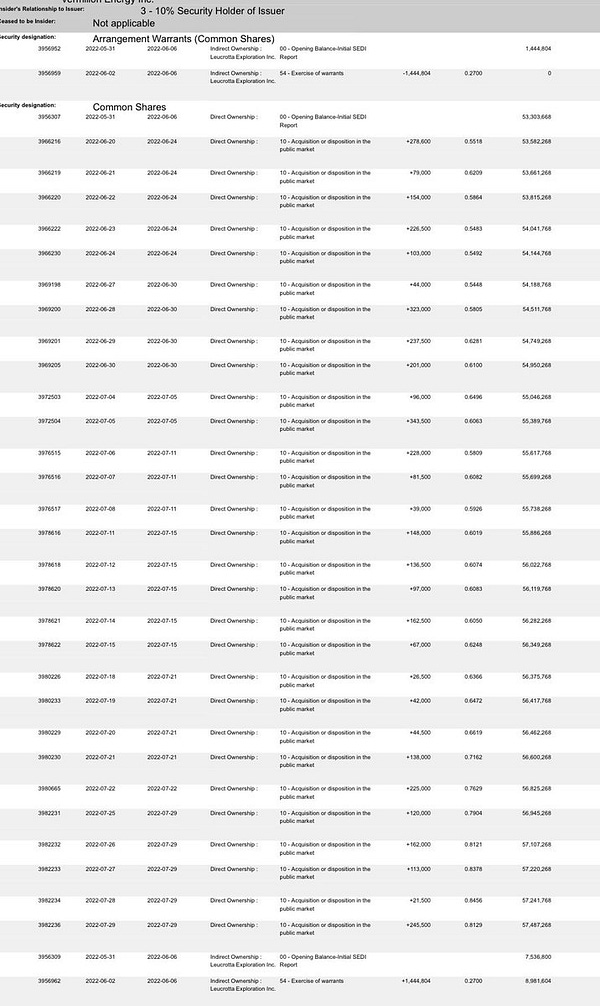

https://docs.google.com/spreadsheets/d/1KqXzZ1I_ln39TYttCeYvrkuzcHNe4sojDrKZ931SZb4/edit?usp=sharing

00:08:30 @WhiteTundraSG joins (RIP Audi Q7). Shubham has been getting peppered with e-mails about TVE dilution. Deja vu to SGY in late 2021. Tamarack Valley is well positioned if WTI remains strong.

00:15:00 MEG issues 3-4 million shares every year, Shubham doesn't see it as an issue as they should be removing 1.5%-2% of the float a month in Q3.

What does MEG look like at the end of 2024? 251M shares. $49 USD share price ($63.09 CAD). 13.2% FCF. Market cap of $12.3B, $440.5M debt (EV of $12.7B). Annual yield of $3 (6.13%). If you bought your shares at $13.86 (Q2 2022 closing price $13.86), 21.7% yield on cost.

Assumptions (1 of 2): Per Q FCF of $317M (2X turnarounds in Q2 23 and 24) to $418M (Q4 2024). For reference, 2022 FCF for Q1 was 389M 1and Q2 was 292M. Debt target 1.2B hit in Q3 2022; 600M target hit in Q2 2023.

Assumptions (2 of 2): - Zero dilution between Q3 22 - Q2 23 (up to 10% FCF used to dilute after that period). - 25% FCF buybacks in Q3 22. - 50% buybacks in Q4 22 - Q1 23, - 40% divvy, 40% buybacks in Q2 23 - 45% divvy, 45% buybacks Q3 23 - Q4 24.

If this part of the Space made no sense, you can check out COM valuations spreadsheet for the MEG valuation.

00:19:00 Shubham says it will be time to look at MEG's approved expansions if the company still exists in 2024. U.S. Shalecos could come in and start buying things up, just like in the Montney. It's cheaper for them.

@AhmedBa44329064 and Shubham discuss MEG expansions -- MEG will probably keep the status quo. If MEG is bought out, the acquirer will be the one to execute the expansion projects.

00:27:00 @puckdunk discusses potential pipeline issues that could cause WTI differentials to blow up. Political risk -- Kazakhstan is oil-rich, but has Russia-related issues. Would the U.S. take on the risk of Canadian government?

00:33:30 @thebiglong9 joins. Despite trailing data not indicating this: IPCO has been buying back shares at an incredible rate.

@kanaljen says the IPCO share count is 142M, which would be 8.5% of the float bought back, by far the most among #COM stocks (IMO 6.1% is second). @AhmedBa44329064 discusses $FANG's guidance.

At current pricing, FANG is guiding buybacks. Ahmed says $AR (Antero Resources) is guiding in similar fashion. 00:43:00 @Josh_Young_1 says $PXD bought back 2.5% of its shares recently (in July alone?!).

Why is $VET so undervalued? Shubham very few people are putting in the work to understand the company. With a NCIB in place (as of 22-JUN), a small float, and TTF at $61/mmbtu. ...

Is the $VET capital return program an issue?

00:49:00 What about $VET's purchasing of Coelacanth shares?

00:55:00 @thebiglong9 asks Shubham what company has the biggest upside in the next 6-12 months?

discusses Coelacanth and the issues of drilling in extremely rural areas.

1:04:30 Big asks about $RBY. There is some debate about the quality of the assets.

1:12:30 Professor @rockcreekfreak hits the stage (class is in session!). Rock says we should wait a few months before trying to determine the quality of Rubellite's wells.

1:18:00 Rock discusses $ERF's assets that were recently purchased by $JOY.

1:32:00 Rock discusses the Montney, $ARX's amazing Kakwa asset, natural fracking, and much more.

1:44:00 Rock discusses his recent thread on $OBE. "It's easy to get demoralized. ... It's good to see stuff like this, the revitalization of $OBE."

2:01:30 Rock discusses what he has been seeing in the markets. @InvestInOnG has bought some $OBE and $OBE calls. What was the most impressive earnings report to date? Deep likes what Obsidian reported.

$CVE had nearly $700M in hedging losses in Q2 despite buying back their hedges.

Deep delves into some of the problems $CVE identified in its earnings. The triumphs (and mostly) travails of integrateds vs. E&Ps. ... Whither Suncor?

$UAN announces a huge special divvy, Deep and DS discuss going in and out of companies, @mfwarder being a prime example of how to do it properly.

2:15:00 Some companies that did very well FCF-wise this Q (WCP, CPG, AAV and others). Advantage looks good.

Breaking out the Oujia board to reach out to @jim_duffus in the great beyond (before he replaces his phone). Shout-out to @WhiteTundraSG for his latest macro session.

@AhmedBa44329064 discusses macro issues, including the Rhine water levels dropping, and Norwegian hydro issues. 2:21:00 @mfwarder discusses coal. ARA (Amsterdam-Rotterdam-Antwerp) stockpiles are high, but can't be delivered to Germany. "If it's not one thing, it's another."

Matt says producers (e.g. CEIX and BTU) shouldn't suffer -- but some revenue might be pushed from Q3 to Q4. Could ARCH sell met coal into the European thermal market? Up to 5M tons of U.S. production could be used by Europe.

Matt discusses ARCH's earnings miss, and what to look forward to? ARCH met coal could go to Europe, what about ARCH's PRB tons? What is $BTU's strategy? BMW assets at sale prices. In terms of capital returns, Peabody will be the last domino to fall.

Matt uses BTU calls to hedge his positions.

2:32:00 Deep in shock that BTU didn't know about German regulators loosening emissions requirements. Matt discusses the Manchin Bill. The Mountain Valley Pipeline is a key element.

Pivoting back to ARCH, Matt sees "steady-as-she-goes" in Q3. For AMR, Matt sees a good quarter, but costs might have gone up. CEIX should have an OK quarter. Do their costs guide up? They are a 2023 story. BTU is a '24 story.

2:49:00 discusses $WHC and $NHC. Whitehaven is a set-and-forget stock for Matt, with a clear capital-return policy and potential to increase production. The Manchin bill has a methane-emissions clause. Deep, @IlliniProgrammr and Shubham discuss.

3:06:30 The subject switches to nuclear. The expectation is that Manchin will get something done to push more nuclear in the future. The conversation switches to the broader economy; job loss and how it ties to commodity demand.

3:23:00 Is the issue $90-$100 oil or crack spreads as Chinese and Russian refined products aren't coming to the U.S.

3:33:00 @ReserveList asks about bullwhip effects in pricing for electricity, aluminum and coal.

Share this post