00:05:30 @RazorOil feels bad for me! He should, I got nothin'! @HalfbeardCanada joins the stage.

00:12:30 If you're feline down, spay around for Razor's jokes.00:12:30 If you're feline down, spay around for Razor's jokes.

Razor discusses volumes from yesterday's trading. Colombian names such as $PXT traded at massive volume. Other names: $CR, $ROK. 00:19:00 @InvestInOnG discusses the Colombian energy tax that was a drag on companies with exposure (e.g. $GTE, which had good earnings).

$VTNR was nearly cut in half after a horrific earnings. No falling knives were caught. Deep: "The market spoke."

00:24:00 @AhmedBa44329064 reads a shocking sentence from the Vertex earnings call then switches to a discussion of $BNE.

Unlike $VTNR, Bonterra had killer earnings despite a large CAPEX increase. Ahmed moved out of his Colombian holdings in April-May. @KramerKarma1 is a noted $BNE bagholder.

33:30 @SteveWps starts a discussion of Iran's potential impact on the oil market.

00:39:30 @C_Mercanti joins to discuss how #COM Spaces keep us aligned/focused. He would like to have a #COM meet-up in Calgary soon, and drops that he works in the nuclear industry. We need to have him as a featured guest soon!

@ReserveList calls out the nuclear Twitter gang known as the #uraniumassholes and asks about open short positions.

00:51:00 @jleqc joins us from vacation and discusses my recent decision to swap $ERF for $CNQ.

00:59:00 @WhiteTundraSG joins and gives a U.S. rig count update.

Shubham sees inflation as perhaps double what companies are reporting -- closer to 30% instead of 12%-15%. He sees Russian production declining. Sakhalin-1 is down to zero barrels, and Sakhalin-2 is the one to watch. Putin is pressuring Western companies to return.

Shubham says Kazakh production is also down quite a bit. This all adds up to "insane volatility."

1:07:30 @rockcreekfreak begins a discussion of $SDE. Spartan Delta's earnings looked very good.

$CR and $SDE condensate growth has been very good. Spartan should be debt-free by YE. Could they go out and buy something? Shubham gives his thoughts. Deep brings up $BIR. Birchcliff or $AAV?

1:19:00 Shubham discusses $DVN -- a U.S. shale play. OK, Shubham is always awesome, but this is next level: $DVN could be the model for Canadian debt-free companies. Pay out 10%-15% divvys and using additional FCF to acquire production.

If share prices were going higher, consolidation would be thriving right now. All the little companies have failed in the Montney. It's a big-boy play. Shubham thinks the privates will be bought out first. Rock and Shubham talk about how PE is selling and bailing out of energy.

Deep: Is credit market hostility to energy stocks slowing M&A by forcing companies to delever before looking at deals?

1:35:30 Special guest star @In_Sapiens jumpstarts the $BNE conversation and provides his thoughts on creditors' desire to finance #COM companies.

"It's a really strange, bifurcated market." Some deals are able to get done, but some bridges are being burned. @In_Sapiens is a great source of info, and #COM would be lucky to have him on stage more often. 2:11:30 @SHOPGod2 makes an all-too rare appearance! Oilyana update!

"Sleep with somebody, anything and get it pregnant"!? ** NO RECOMMENDATION! ** Shout-out to @BubleQe! The man has been on $CR and $KEL for a long time. Burping the alphabet and congratulations to @AlexVergeJOY

2:19:00 Why was $MEG selling off?

@timber001 on #COM population growth, and how it appears the $MEG sell-off is complete.

2:35:00 the conversation moves to $ERF and $JOY. 2:44:00

@RazorOil, @Madonna, a soundboard, and a ton of club drugs take stage to discuss the Serafina deal.

Razor pivots to discussing the value of companies by evaluating their components. Most Canadian assets are in the sands. Razor posits that the market isn't properly valuing these assets, invoking @OHare888 and Mario Gabelli.

https://en.wikipedia.org/wiki/Mario_Gabelli

Could Venezuelan/other heavy crudes easily replace Canadian heavy? There is political uncertainty in places such as VZ, and decline curves don't exist with Canadian heavy. Razor notes all the positive, LEGIT ESG activities of Canadian companies.

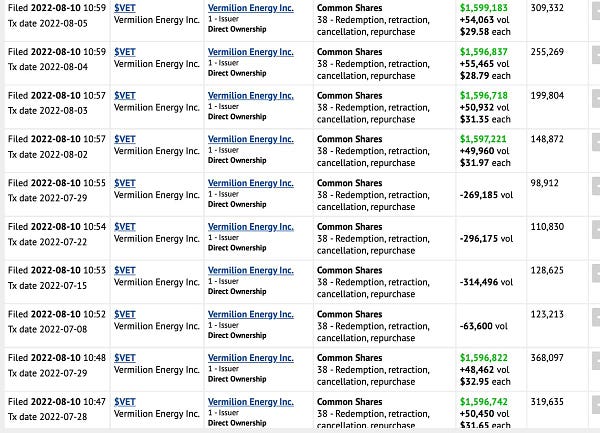

2:58:30 A modest proposal -- banning Madonna and Wham! @MiserMcMiserson discusses the various heavy oils from a refining perspective. Miser discusses potential UK blackouts. Deep: $VET down 10% on the news. Fracking in Germany? $VET up 10%?

discusses $VET earnings. How much TTF upside will $VET capture? 3:07:30 Please excuse my angry German Shepherd. She's barking at the replay as I type this. Per latest $VET PPT, Corrib is ~60% hedged for '22 and 30% hedged for '23.

https://www.vermilionenergy.com/files/Vermilion_Energy_-_Corporate_Presentation_-_July_2022.pdf

Germans like to prepare for cold, wet winters -- even if it's August. ... In Florida. She suggests a snappy coat and some $VET (shares or options). No recommendation.

3:10:00 Brian begins a discussion of LNG and U.S. and Canadian gas pricing. Eventually our #COM portfolios might look like this after M&A:

·

2:58:30 A modest proposal -- banning Madonna and Wham! @MiserMcMiserson discusses the various heavy oils from a refining perspective. Miser discusses potential UK blackouts. Deep: $VET down 10% on the news. Fracking in Germany? $VET up 10%?

Quote Tweet

Bloomberg UK

@BloombergUK

· Aug 9

EXCLUSIVE: The UK government is planning for several days of organised blackouts this winter for industry and households under its latest “reasonable worst-case scenario” https://trib.al/ljWNO1J

·

discusses $VET earnings. How much TTF upside will $VET capture? 3:07:30 Please excuse my angry German Shepherd. She's barking at the replay as I type this. Per latest $VET PPT, Corrib is ~60% hedged for '22 and 30% hedged for '23. https://vermilionenergy.com/files/Vermilion_Energy_-_Corporate_Presentation_-_July_2022.pdf

·

Germans like to prepare for cold, wet winters -- even if it's August. ... In Florida. She suggests a snappy coat and some $VET (shares or options). No recommendation.

·

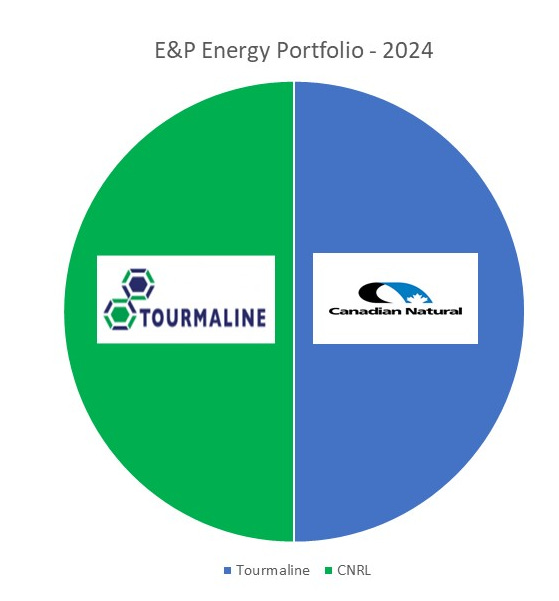

3:10:00 Brian begins a discussion of LNG and U.S. and Canadian gas pricing. Eventually our #COM portfolios might look like this after M&A:

Quote Tweet

QE

@BubleQe

· Aug 4

My likely E&P Energy Portfolio in 2024. Considerations given for my existing E&P names: M&A. $TOU.TO $CNQ $CNQ.TO #COM @AssetTraveller @BJamz2022 @JoeBeattie11 @nyetjgoldblum

Jenny helps build excitement for $VET earnings.

3:15:30 @InvestInOnG is bullish $BIR. He likes the access to Dawn and Henry Hub. Sadly, it's hard to get access to what Dawn pricing is (it's better than AECO, though). $TOU, $BIR and $VET are examples of Canadian companies that get premiums for their products.

3:19:30 Speculation on top picks for Friday's @AndrewBellBNN Market Call. Could Eric pick $OVV? $MEG? Other names? While we're at it, shout-out to BNN's @margot_rubin, multimedia superstar and frequent visitor to #COM Spaces. Thanks, Margot!

More discussion of buybacks and divvys. In the coal space, companies such as $AMR are buying back, but latest numbers show no dent. Google Finance data isn't updated to show that $IPCO has taken some of it's float off the market.

$ARCH actually puts data from its earnings reports on Excel docs you can download and play with. THIS IS THE WAY.

https://investor.archrsc.com/quarterly-results

3:25:00 Are we at peak ESG? Deep: People will perish before governments change. What about fund managers?

3:27 @BrianjBabbage was at a PE/VC conference and attempted to be cool, contrarian O+G kid. There was receptivity to nuclear, but Brian was a pariah for mentioning oil.

#COM: Happy to kick anyone in the nuts if they try to make Brian a pariah. @DSteinmoeller discusses Eric's top picks and goes with OVV, BTE and ... Canadian barrels = good barrels. A request for @oilandgasrebel to come on a future Space and discuss $RZE Q2 earnings.

3:33:00 @timber001 teases a name that might be announcing divvys in Q3. Are meat prices dropping?

High-Energy Tuesday