00:02:30 @OneMoreif and @Davis_Kelly1 joins, Aussie coal is up. Time for an acai bowl! Aussie loves $YAL ... except for the things he doesn't love.

00:12:30 Aussie thinks when $NHC reports (Thursday in Oz) any production misses might spill over to drop $WHC.

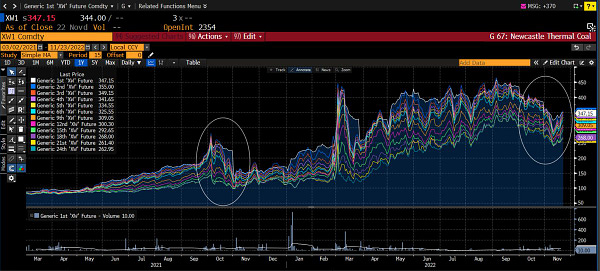

00:17:00 @mfwarder: Shoulder season is here in Europe, coming soon for NEWC and Richards Bay. Aussie is a trader who adjusts to a volatile market. He suffered pain buying earlier in shoulder season, but the thesis hasn't changed. @manchkin: Pricing changed, but value didn't.

00:26:00 EU coal-power generation is way up. Korean power gen going up, but it's early. Aussie asks about weather being a factor. Matt is thinking more about La Nina causing supply constraints and hurting $BTU, $NHC and $WHC.

00:36:00 Coal had a day, helping $CEIX nicely. The conversation pivots to communications coming from U.S. coal names. Last year, #CoalTwitter was lamenting poor communications. Bottom line: Things are improving.

00:42:30 When will coalco M&A become a thing?

Matt touches on $BTU-Coronado discussions. @jleqc's burner asks about shoulder season -- does the market correct for it? Matt is adjusting his holdings based on the paper hands in the trade. If you're thinking long-term, you probably shouldn't care.

01:10:30 @AhmedBa44329064 asks if Japan's decision to restart nuclear will affect coal/NG demand. Bullish uranium/turtlenecks despite the cries of Mitch Hedberg and Gaylord Focker. @PersonaWired and @WhiteTundraSG join.

01:26:00 @RazorOil discusses the previous day's Space with @anasalhajji @Amena__Bakr and @UrbanKaoboy. Razor usually keeps his powder dry, but he was concerned about Monday's WSJ story because many investors suffered material losses in the wake of debunked reporting.

01:50:00 @WhiteTundraSG says oil inventories are getting harder to track. I heartily recommend folks new to Canadian energy stocks watch Shubham's Q3 preview of 57 companies:

The conversation moves to Russia and energy-related issues, such as production, transport and storage.

2:06:00 Shubham notes fake news regarding BP's U.S. liquids production then notes how today's OPEC is much more coordinated and steadfast than in the past.

2:12:00 @Nandospage discusses $IPCO with Shubham. Nando notes Nigerian and Angolan production has dropped. James and Jleqc discuss potential reasons behind the push for solar and wind. @mfwarder markets to Illuminati in the audience and notes the left is looking at nuclear.

If countries aren't investing in nuclear and/or natural gas, then coal has a longer runway unless capacity is demolished.

2:29:00 Aussie says countries are going all-in on renewables but they don't make money, which leads to carbon credits and other schemes.

It's not about energy security or profits, it's about forcing people to shift. "ESG is just getting started." @InvestInOnG suggests that it will take pitchforks will be required for policy change. Matt thinks the ballot box will be the answer.

Nando discusses the end goal -- is it to reduce population in the West? Aussie sees the East rising because it doesn't embrace this ideology.

2:45:30 @gnostic joins and draws parallels between the green advocates and the vaccine advocates.

2:58:00 @energyburrito joins and discusses how energy Spaces help educate all of us, then discusses the uranium thesis. Things just keep getting better. Deep: The greens win the communications battle because fossil fuel advocates don't put a human face on things.

Deep also makes the case for trying to improve the world in addition to profiting off the mistakes being made by world leaders that will lead to suffering. Nando, Shubham and the Burrito provide perspective and agreement.

3:14:30 What are upcoming catalysts for our investments? The group provides their ideas.

@PersonaWired asks about some background data on the energy trade. The below Space with @YellowLabLife provides a lot of excellent info on the coal trade and $WHC in particular.

This Space featured an @mfwarder master class on coal.

This is a classic example of a @WhiteTundraSG deep dive. He breaks down assets and provides valuations of three energy companies, including #COM darling Vermilion (note: this is pre-Windfall Tax discussions).

High-Energy Tuesday