$WCP / $SPGYF -- aka Whitecap -- announced an acquisition that got a lot of us thinking.

00:04:00 @jleqc on buying more time with options and treating the options differently than you do your stock holdings.

00:11:30 @RazorOil it's a game of controlling your emotions. A lot of things in the market don't make sense. Alex doesn't do options.

Alex shocks me with something I had missed completely: $MEG / $MEGEF announcing a large drop in production.

https://www.megenergy.com/investors/news-releases/news-release-detail/?id=122711

This begins an excellent discussion with Alex and @BJamz2022 on the inner workings of SAG-D facilities and issues they can face.

00:22:30 How will this impact Q2 earnings (will it allow an entry point for investors if MEG dips)? Alex says that all SAG-D operations can have these kind of turnaround issues.

Mark: You don't lose the barrels, production is being deferred. You'll see higher production in '23.

00:31:00 Mark mentions that U.S. refineries will have some real production issues when they perform their turnarounds because they have been running at max capacity for the last 18 months.

00:37:00 @IlliniProgrammr thinks the MEG news could drive some selling -- especially when Q2 results are released.

00:42:00 @timber001 discusses funds dumping energy stocks at the end of each quarter so they aren't listed on holdings reports. The funds then pick the stocks back up at the beginning of the next Q. Buying opportunity?

@jleqc muses on a lifetime of charting and walking away from it -- to an extent.

00:57:30 @IlliniProgrammr The EIA information release could have been a negative factor.

Illini has been buying. @timber001 disagrees and believes the EIA has provided bullish information. Why does @GasBuddyGuy data not mesh with other sources? I believe this disconnect between data sources is a reason for the volatility we experience.

@UndervaluedOnG and @AhmedBa44329064 join the discussion.

01:18:00 @IlliniProgrammr discusses producers selling puts before increasing production, mentioning his question to $SGY's Paul Colborne.

1:25:00 discussion of @sohaibab9's Space with $VET.

@MasBest2point0 discusses @Michael71718318's comments about long-term thinking vs. short-term worry. CaPowers bought WCP calls and thinks the company is bullish NG.

1:31:00 @jim_duffus on golf issues and $WCP. $MEG is now Duff's largest holding. Duff attended meetings with Saskatchewan officials. ... Duff finds out about $MEG.

Duff discusses helium, rare earths and other commodities initiatives going on in his part of the world.

@BJamz2022 $VET focusing on Europe, rather than Canada and its recent Leucrotta purchase. I have their FCF at 46.4% at year end.

Mark: The Montney is known. What do we know about the reserves in Hungary and Croatia. What is the risk/reward ratio? @CouldBeMistaken provides his thoughts on $VET and $OBE.

2:06:00 @C_Mercanti asks if Q2 earnings will end the malaise in #COM names? @JamesHMackay and @timber001 provides thoughts. Buying opportunities before earnings or after?

Joe S. and @BubleQe ask that companies describe their intentions and then follow through. "Don't surprise me after I've piled in."

2:13:00 Good Cap / Bad Cap. Whitecaps projected debt targets look achievable. They identified dividend targets, yield ~8%, and a corporate presentation isn't a prenup. If they screw it up ... WCP will get the ass-whipping of ass-whippings by investors.

2:18:30 @UndervaluedOnG weighs in on WCP comparing this acquisition to $CPG's acquisition. JSG also is considering reserve life, which is why he loves MEG.

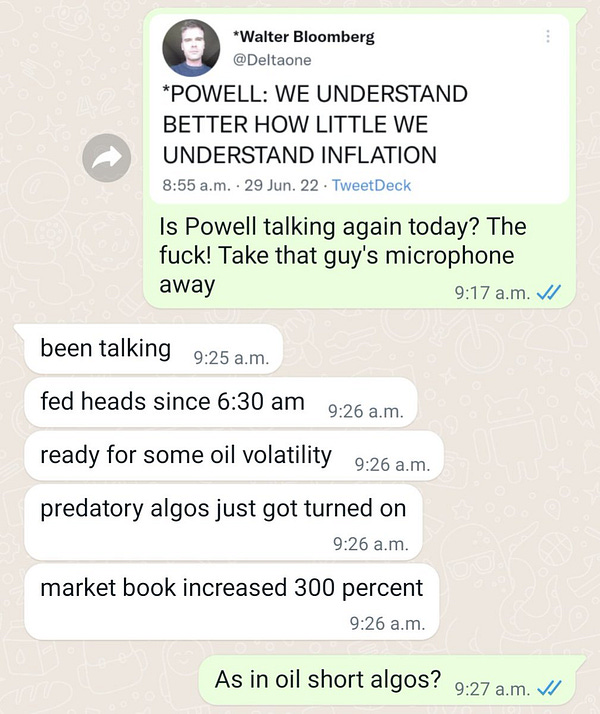

2:22:00 **** @JamesHMackay identifies why stocks dropped later yesterday. Fed leaders met in the a.m., and when negative headlines started coming out with JPBS (Jerome Powell BS), a trader friend of James' said the oil-short algos activated. ****

@dyer440 points out the ramifications of Queensland's royalty increases (bullish for U.S. producers).

James recently bought $WHC / $WHITF, which is in New South Wales, and has not raised royalties.

2:32:30 @DSteinmoeller joins to discuss "baby CNQ" $WCP. This acquisition fits their playbook. Grant owns enough shares to operate with self-interest in alignment with shareholders.

@jleqc references @jenstilmanydots and her excellent threads on $WCP.

@AhmedBa44329064 the Whitecap share buybacks will not be happening soon. Integrity 101. The assumption is we will pay a premium for companies that clearly communicate their intended actions and act accordingly.

2:54:00 @CouldBeMistaken identifies a downside to committing too much FCF to dividends -- the loss of strategic optionality (inability to flex into acquisitions, buybacks, growth CAPEX).

James won't wait for buybacks. They should be happening now. Whitecap will not be in any position to buy shares if the price plummets. Pivot back to $VET and Leucrotta. Mark notes Europe isn't looking at realistic solutions.

3:10:00 Alex isn’t a fan of the $WCP deal and details his rationale.

Alex thinks it is remarkable that the company didn't get punished.

3:22:00 An LNG Canada project to support Europe?

@DSteinmoeller Canada will do what is asked of it.

Legend of the #COM, @emmpeethree1 asks how long would it take for a pipeline to be completed?

Shout-out to MP for helping set up the $VET Space with @sohaibab9

Joe S. recalls a conversation with @ManchesterUtd81 -- it'll take a war to spur things.

@CouldBeMistaken a hot war could begin if Russia cuts energy to W. Europe. Could that open the door to waivers, and allowing European countries to purchase Canadian assets? What if Nordstream is attacked? MT buying "shitcos." He thinks NATO will fight.

@aberadabra asks about Canada replacing Russian energy. A discussion of nuclear, coal and NG ensues.

4:05:00 *** @InvestInOnG's alter ego, ANGRY DEEP, makes his Spaces debut with a rant entitled, "Jay Powell's ugly-ass face" ***

@lyearwood87 is over 60% cash. He started buying last week. He takes us out with a hilarious tale of rubbing elbows with celebrities in Pebble Beach.

Share this post